The leading active exchange-traded funds (ETFs) of 2025 so far have been from ARK Invest’s innovation-based range as well as those investing in European or emerging market equities, FE fundinfo data shows.

An active ETF is an exchange-traded fund managed by investment professionals who make decisions on asset selection in real time. Unlike passive ETFs tracking an index, active ETFs aim to outperform the market through stock selection.

In recent years, active ETFs have gained traction in the UK and across Europe as regulatory changes and investor demand for flexibility have aligned. Asset managers have responded by launching more actively managed products across asset classes, including fixed income and thematic equity.

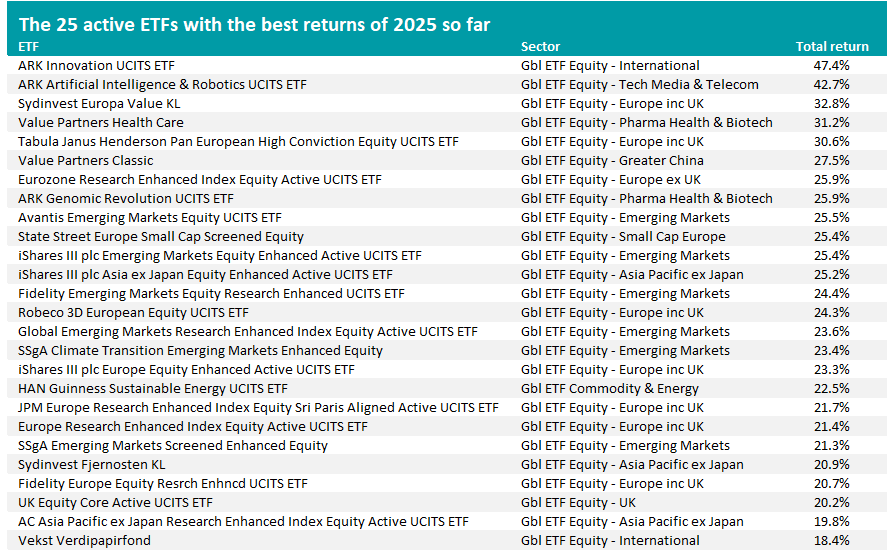

In this article, Trustnet looks at the active ETFs that have made the highest returns over 2025 so far. As there is no dedicated active ETF universe, we’ve compiled the underlying list of funds from the Global ETF universe, using those that have indicated they are allowed to be sold in the UK and do not take a passive or smart beta approach to portfolio construction.

Source: FinXL. Total return in sterling between 1 Jan and 24 Oct 2025

At the top of the active ETF performance table is ARK Innovation UCITS ETF, with a 47.4% total return (in sterling terms).

This strategy seeks to capture long-term growth by investing in companies involved in disruptive innovation. It targets companies that ARK Invest believes are leading technological and scientific developments across five areas of innovation: artificial intelligence (AI), robotics, genomics, energy storage and blockchain.

ARK Innovation’s top holdings include electric vehicle manufacturer Tesla, trading platform Robinhood Markets and cryptocurrency exchange Coinbase, all of which have posted strong returns over 2025.

In a recent note, ARK Invest argued that a “remarkable convergence” is taking place in the five innovation areas the fund invests in and predicted this will “reshape industries, societies and the investment business in profound ways”.

“Each of the innovation platforms is significant, likely comparable to that of the internet which, since the turn of the millennium, has generated over $10trn in global market capitalisation,” the firm said. “Now, as the five platforms advance and interact, the potential for economic impact and value creation is likely to be ‘super exponential’.”

It is worth noting that while ARK Innovation is the best active ETF over the year to date, some passive ETFs have performed much better this year: nine of the 10 strongest ETFs all invest in precious metal miner indexes and have made in excess of 100%. In all, 56 passive ETFs – largely investing in areas such as commodities, Korean equities, financials, tech stocks and Europe – have outperformed the ARK ETF over 2025 so far.

ARK Invest has another two products on the list of the active ETFs with the year-to-date’s highest returns, including ARK Artificial Intelligence & Robotics UCITS ETF in second place with a 42.8% total return.

This strategy invests in companies involved in AI, autonomous technology and robotics, which have had another strong year in 2025. The portfolio’s largest holdings include Tesla, data analytics platform Palantir and chip developer Advanced Micro Devices.

AI‑focused stocks have generally performed well in 2025, with standout gains from names such as Palantir (up over 100 %) and strong double‑digit returns from established infrastructure leaders such as Nvidia (up around 50%). The gains are being driven by robust demand for AI hardware and software, investor sentiment towards the theme and strong earnings growth.

ARK Genomic Revolution UCITS ETF, which is in eighth place with a 25.9% total return, focuses on companies using technological and scientific advances in genomics to improve the quality of human and other life, offering products or services based on genomic sequencing, analysis, synthesis or related tools. They may operate across sectors such as healthcare, IT, materials, energy and consumer goods and may specialise in areas like bionic devices, bioinformatics, molecular medicine and agricultural biotechnology.

Explaining the investment case for the theme, ARK Invest said: “The plummeting costs of genomic sequencing and the rise of multiomic technologies are unlocking unprecedented opportunities in healthcare. Our journey into the molecular fabric of life itself is transforming our approach to diseases that have long evaded cure, particularly rare genetic disorders and cancer.”

Europe is another theme among the best-performing active ETFs of 2025 so far, with nine of the 25 funds in the list above investing in this part of the market. These include Tabula Janus Henderson Pan European High Conviction Equity UCITS ETF, State Street Europe Small Cap Screened Equity and iShares Europe Equity Enhanced Active UCITS ETF.

European markets have performed well this year because of their heavy exposure to the industrials, infrastructure and defence sectors, which rallied in the first half on increased fiscal spending and pledges to boost defence budgets. Also, inflation in the region has moderated and the European Central Bank has signalled a potential shift towards easier monetary policy.

Another trend in 2025’s best active ETFs is emerging markets, with Avantis Emerging Markets Equity UCITS ETF, iShares Emerging Markets Equity Enhanced Active UCITS ETF and SSgA Emerging Markets Screened Enhanced Equity among those in the top 25.

Emerging markets have underperformed the developed world for a lengthy period, leaving them more attractively valued than the US, where investors are starting to develop concerns about how expensive some stocks have become. Furthermore, a weaker US dollar and interest‑rate easing in many emerging market economies have improved the investment climate for those markets.

Of the 200 or so active ETFs we identified in FE fundinfo’s data, only six are making a loss this year: Ossiam Food for Biodiversity UCITS ETF, SPDR Bloomberg High Yield Bond ETF, PIMCO US Dollar Short Maturity Source UCITS ETF, Invesco AAA CLO Floating Rate Note ETF, JPM USD Ultra-Short Income Active UCITS ETF and SSGA SPDR Blackstone Senior Loan ETF.