Copper and gold have been standout performers this year.

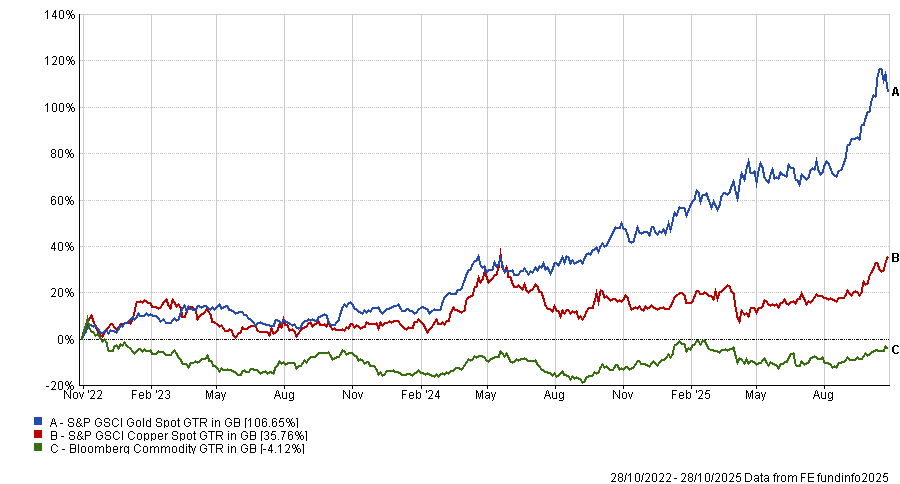

The Bloomberg Commodity index lost money over three years, but both S&P GCSI Gold Spot and S&P GCSI Copper Spot made over 100% and 30% over the same period, as shown in the graph below.

Performance of gold and copper vs index over 3yrs

Source: FE Analytics

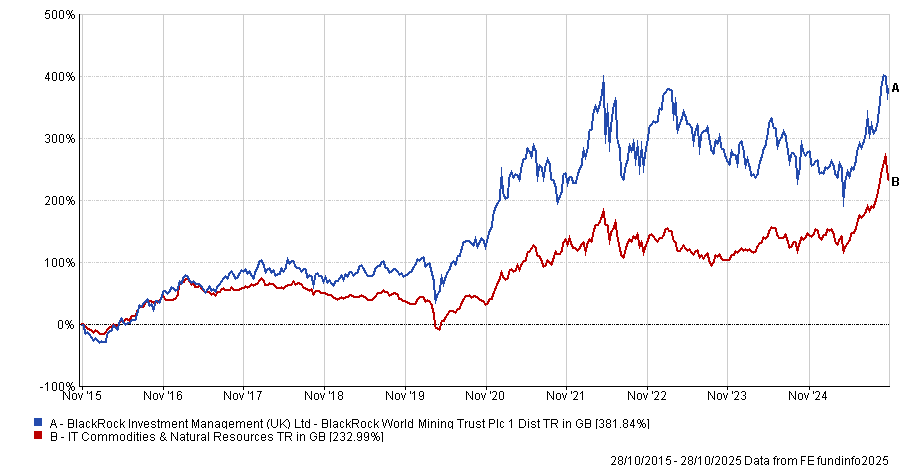

The BlackRock World Mining trust has reaped the benefits, with the two precious metals being its biggest drivers of returns this year. Copper and gold accounted for nearly 60% of the portfolio as of the end of September 2025 – at 20.6% and 37.3% respectively.

While co-manager Evy Hambro remains constructive on their outlook, he argued that the broader commodities universe remains largely untapped, with investors risking missing out on critical minerals and rare earths in particular.

Performance of the trust vs sector over 10yrs

Source: FE Analytics

The main push behind gold’s outperformance in recent months has been currency aversion, Hambro said.

“People generally are worried about the rate of government spending and balance sheets, so they are looking to allocate away from cash and government bonds, which is leading them into things like gold or real assets – even crypto,” he explained.

“Until governments can show an action plan to tackle some of the challenges they face, it is going to be very difficult to change the direction of this trend.”

Meanwhile, copper remains an essential component in future-proofing the world’s energy supplies – whether that is moving away from fossil fuels to renewables or looking to power the rollout of AI and data centres, he added.

“You cannot do any of that without copper,” Hambro said.

Is a commodity boom on the horizon?

However, while copper and gold are outperforming today, Hambro expects to see a broader commodity boom in the near future. The last boom in the asset class harkens back to the early 2000s, following a drastic upscaling of construction activity and urbanisation in China.

Gaining access to other commodities across the critical minerals and rare earths universe certainly forms a dominant part of government policy, but the same cannot yet be said for investment portfolios.

Hambro’s theory for lack of investor interest is that most of these materials and earths are “invisible” in everyday life – rarely noticed by consumers and therefore overlooked by investors.

“If the price of copper goes up or down, this does not change the everyday person’s life – not like you see with the price of food or when you fill up your car with petrol,” he said.

The term ‘critical minerals’ refers to materials essential for modern technologies and national security, while ‘rare earths’ are a more specific subset of these – a group of chemically similar elements used in high-tech applications like magnets, batteries and defence systems. China has an around 90% market share of the latter group, with the remainder largely in Australia.

“The technology drive of today, with hundreds of billions of dollars being spent on data centres and being funnelled into the grid, is incredibly commodity intensive – driving demand for both critical minerals and rare earths – but many investors have not yet made the mental jump to look upstream,” said Hambro.

“There is a complacency issue there and investors aren’t building exposure in their portfolios. But this is the biggest mistake they are making.”

It has been a core theme for BlackRock World Mining Trust, Hambro said, noting that the portfolio has had exposures to rare earths alongside critical minerals.

“It may take one of the big-tech CEOs announcing they have to slow down growth plans because they cannot access enough rare earths to get investors’ attention – this will cause the price to jump up and we are probably not too far away from that,” he said.

“After all, if governments are worrying about [supply], then companies are, too.”