US tech giants have had a mixed earnings season so far, with Alphabet the standout winner while others such as Tesla and Meta have disappointed investors.

While some have dropped, it does not eradicate the strong gains made by the ‘Magnificent Seven’ companies of Alphabet, Amazon, Apple, Meta, Tesla, Microsoft and Nvidia so far in 2025.

Their performance has helped the S&P 500 and the Nasdaq Composite to rise 5.8% and 9.7% respectively, shaking off the ‘Liberation Day’ inspired downturn.

But Raheel Altaf, FE fundinfo Alpha Manager of the Artemis SmartGARP Global Equity fund, argued that it is still a struggle to find compelling opportunities in these names, noting there are “not a lot of opportunities left in tech and the US”.

On the tech side, many companies' valuations have gone “exponential”, which is challenging to justify for his ‘growth at a reasonable price’ strategy, outside of a handful of exceptions.

Meanwhile, there are “concerning indicators” for the health of the US market, which have been amplified by president Donald Trump’s tariffs. While the trade levies have yet to show up in company reporting, Altaf argued they are likely to be highly inflationary for the consumer, which has caused him to reduce his US allocation to near all-time lows.

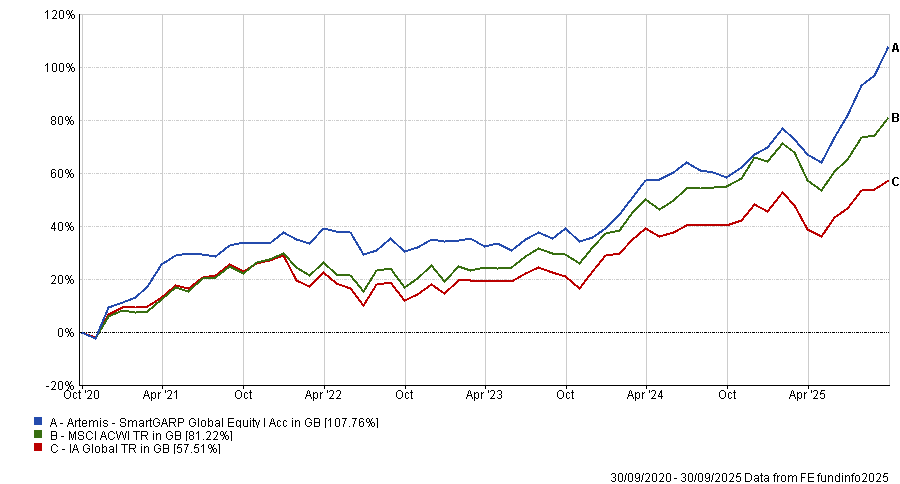

This has not held his portfolio back, however, with the strategy ranking as one of the top-quartile global funds this year, as well as over the past three and five years.

Performance of the fund vs the sector and benchmark over 5yrs

Source: FE Analytics

What is the process of Artemis SmartGARP Global Equity?

The fund follows the same process as the rest of our SmartGARP range. We use a disciplined stock selection process that is data-driven and systematic in nature, constantly screening for company fundamental data, behavioural insights and share prices.

We try to come up with building blocks that can help predict share prices and then combine those to give an overall view on whether a company looks attractive or not.

What differentiates it?

One of the big advantages of the process is that we’ve got this very consistent framework that we are applying through time, looking at fundamental characteristics and constantly screening through more than 2 million data points.

We think that’s a very efficient framework for comparing companies and their relative attractiveness. We take the best ideas from this screening process and skew the portfolio towards them, which tends to result in something that is very high active share and different from the benchmark.

Why do you not meet company management?

We’ve invested our resources entirely in using data to answer the difficult questions about the company, such as whether it’s well run, if it’s growing profitably and so on. These are all questions the screening tool can answer for us very quickly and efficiently.

Every stock we add to the portfolio, we do some stock-specific due diligence, but we are not trying to reinvent the wheel; we are trying to challenge the company on things like corporate activity or other short-term developments that can create noise.

We then use a ‘common sense’ approach to make decisions on areas that the model can’t capture.

What has been your best-performing holding recently?

CMOC Group, a precious metals and mineral producer based in China and one of the world’s largest cobalt producers, stands out.

China, as we have seen recently, has strategic importance when it comes to the rare earth minerals and metals, which we think will be necessary for the technological and artificial intelligence revolution that everyone has been talking about. We think it’s going to continue to be a big beneficiary of that.

Already, it is up more than 135% over the past 12 months and could have further to run.

What was your worst?

There’s been a lot of competition emerging in the online retailer space, which has made JD.com one of our biggest detractors.

Last year, it had started to look attractive to us for the first time in quite a while, but competition has been rising in the sector, particularly in China, which has been a real headwind for the stock over the short to medium term. It’s down about 16% over the past 12 months.

You just need to accept that you won’t always get it right when it comes to investing. The hit rate on the portfolio is historically just over 50%, so we’ve had to get used to holding some disappointing stocks.

How have you navigated heightened volatility in markets?

With experience, we understand that people tend to get complacent at the top and panic at the bottom and you can take advantage of that. For us, it’s about taking a step back when markets are volatile rather than trying to be tactical.

We’re not the best at taking advantage of turning points for that reason, but we respond and react to regime changes quite quickly.

For example, in the post-pandemic era when interest rates are higher and inflation is higher, a lot has changed in the world and that’s affecting the fundamentals of many companies more than investors think.

I think that’s picked up a lot better by looking at the data but investors who hold hugely successful companies can be slow to recognise that the story is no longer the same.

What do you do outside of fund management?

I’ve got three teenage kids who keep me completely occupied nowadays. Otherwise, my hobbies tend to be very sporty, I go to the gym a lot, play tennis and paddle and used to play a lot of football.