Stock markets have been the place to invest over the past three years, with investors unlikely to make a loss by backing pretty much any equity fund, regardless of what they invest in.

However, there are seven Investment Association (IA) equity sectors where investors could have made a loss, according to Trustnet research.

This included the IA Global sector, where 14 funds have lost money in sterling terms. These underperforming funds are all invested in sustainable assets, such as clean energy, recycling or climate change funds.

Environmental, social and governance (ESG) mandates were extremely popular in the early part of the 2020s, as oil, defence and other sectors typically avoided by these stocks slumped, boosting the relative returns of ESG strategies.

Since, however, these stocks have rallied, with Charles Younes, deputy chief investment officer at FE Analytics, noting that “everything focused on sustainability has struggled since 2022”.

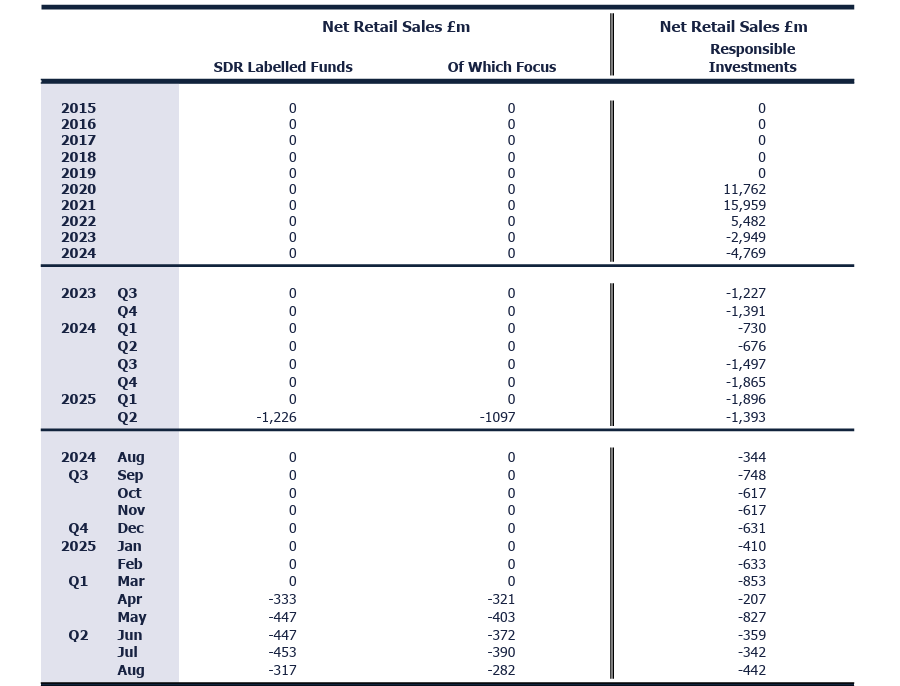

Indeed, according to data from the Investment Association (IA), responsible investment funds have suffered net outflows in both 2023 and 2024, as seen in the table below, as investors turned their attention to more traditional portfolios.

Responsible investment funds' net retail sales

Source: Investment Association

Elsewhere, in the IA North American Smaller Companies sector, the Premier Miton US Smaller Companies has lost investors' money on both a local currency and sterling basis.

Part of this is because the strategy is tilted towards value, while the best-performing small-cap funds “are usually more focused on growth”, said Younes.

As the fund has underperformed, investors have pulled money out, causing the assets under management to slide by more than £150m since November 2022, meaning the managers have become forced sellers of assets.

In the IA North America, just one fund (SSGA SPDR S&P U.S. Health Care Select Sector UCITS ETF) posted a negative total return, down 0.7% in sterling terms.

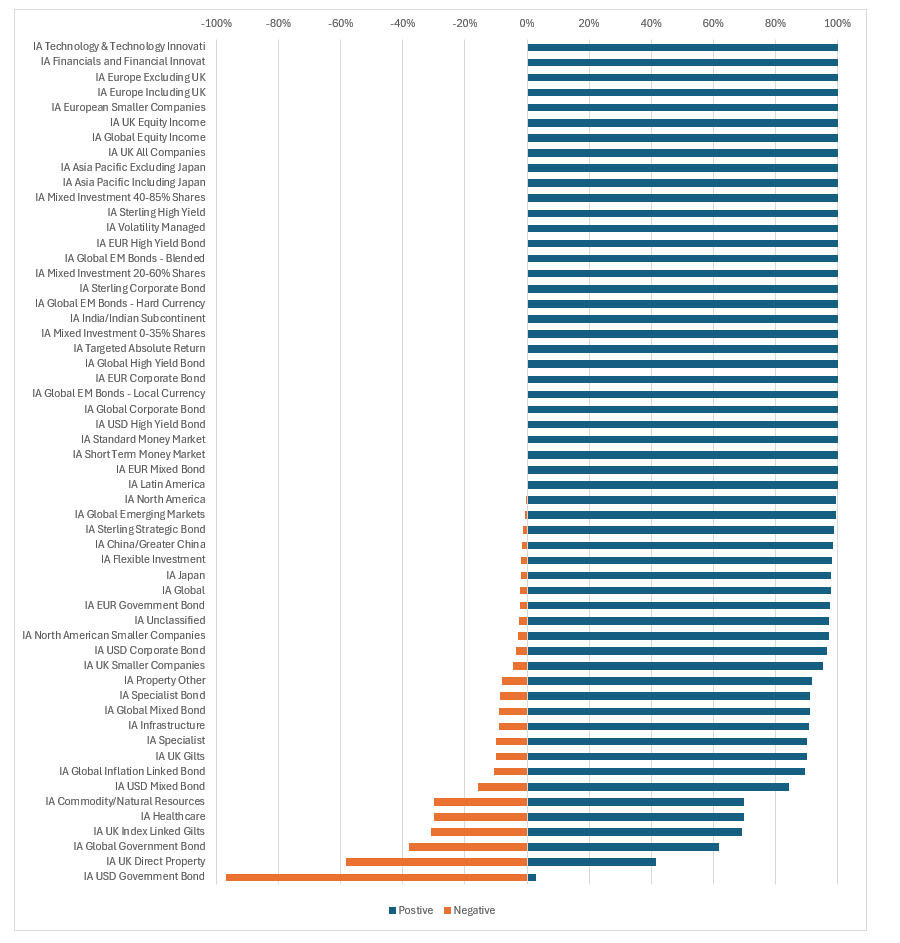

The other equity sectors where funds underperformed are the IA Global Emerging Markets, IA China, IA Japan and IA UK Smaller Companies, as seen in the chart below.

The teal line represents the percentage of funds with a positive return, and the orange line represents the percentage that lost money.

% of funds making positive and negative returns over 3yrs

Source: FE Analytics. Returns in sterling. Data accurate to the end of September.

However, equity-focused sectors have generally performed well for investors over the past three years, with 100% of funds in 30 peer groups delivering a positive total return.

“It's probably not surprising that anything equity-related has performed really well for investors over the past three years,” Younes said, as the figures exclude most of 2022, when most equity markets were down by double digits.

By October 2022 (the period that our data captures), the worst of the downturn was over and stock markets had started to stage a recovery.

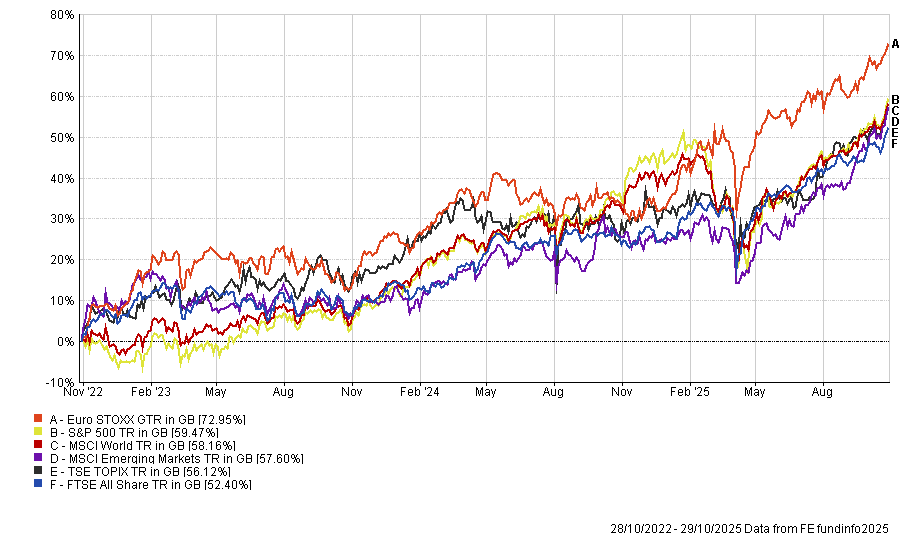

Over the past three years, most equity markets posted double-digit returns, as demonstrated by the chart below.

Performance of global markets over 3yrs

Source: FE Analytics. Returns in sterling.

Any fund or sector with a significant exposure to these rallying markets has done very well, Younes noted. “The more you added equity allocation over the past three years, the higher you tended to go.”

However, certain asset classes have delivered particularly strong performances, he continued.

He pointed to the IA Technology and Technological Innovation sector, where the average fund was up 88.1% over this period, with just one strategy failing to deliver a double-digit total return.

For Younes, the strong performance of funds in this peer group is due to the influence of Nvidia. The company’s spectacular three-year returns (up 1,210%) have made it an increasingly large weighting in tech-focused and US benchmarks. In the Nasdaq 100, Nvidia currently represents 10% of the total benchmark, while in the MSCI World Information and Technology index, it is 20%.

“In this sector, you have to buy Nvidia because it’s such a large proportion of your benchmark,” Younes said. Even a small allocation to Nvidia would contribute to positive total returns over this period, he continued.

There are just two sectors in the entire IA universe – IA UK Direct Property and IA USD Government Bonds – where investors were more likely to lose money than make money during this period.

The IA USD Government bonds sector emerges as the worst performer of the bunch, with just one fund (the Vanguard US Government Bond index) delivering a positive total return.

Younes attributed this to the “massive inflation problems” that started in 2022 and have persisted since, which have caused bond yields to rise, making it challenging for active government bond funds to outperform.

However, part of the poor performance of funds in this sector is also due to currency conversions, with 18 funds delivering positive returns in dollar terms.

Meanwhile, the rationale for funds in the IA UK Direct Property making more losses than gains is a result of the fact that “property has done basically nothing as an asset class for years now”, Younes noted, with the peer group averaging a loss of 4.3%.