When building a portfolio as a DIY investor, it’s important to keep things manageable.

Private investors often like buying stocks and funds – for many, it can become almost a hobby. It’s important, however, that it doesn’t turn into a collecting hobby, as keeping too big a portfolio of ‘collectibles’ can be counterproductive.

One of the biggest mistakes people make is loading up on stocks or funds just because they’ve been recommended somewhere, said Jason Hollands, managing director at Bestinvest.

This is often exacerbated by not having a sell discipline, which means that the collection of ‘hot-tip’ funds becomes too large to manage according to the investment plan – if there even was one to begin with.

This is why Hollands has long kept his own portfolio capped at around 20 funds, not as a hard-and-fast rule but as a personal discipline that keeps him from spreading himself too thin.

“30 or 40 holdings are too many for DIY investors. Are you really keeping an eye on it?” he asked.

“Personally, my rule is 20 because that’s enough to get exposure to all the main asset classes and markets. Then, when you see something new you want to buy, it makes you ask whether it deserves to replace something you already hold.”

Investing isn’t just about the thrill of the find but mostly having a plan and buying things only if and when they make sense in an individual’s circumstances, he went on to explain.

“Saying ‘I’m a cautious investor’ means nothing if then you are buying mining stocks with no overall strategy, just because they are hot at the moments,” he added, arguing that a smaller, more deliberate set of holdings forces investors to think in terms of conviction.

How and when to apply the rule of 20

Before investors add any new holdings, it’s important to look at what’s already in the portfolio.

The perfect occasion for doing so is the yearly rebalance (private investors should rebalance their portfolios at least once a year, according to Hollands).

One way to rebalance is by adjusting current holdings: “Even if you started with a really good structure, things move around. A tearaway year for UK equities might mean you end up with a lot more than you intended.”

Another is when investors put in new money, to focus on topping up areas where there is an underweight. “That restores the balance and makes you think: Am I still happy with these 20 holdings? Do I still have conviction in them?” Hollands said.

When to break the rule

While he has come up with this self-discipline, Hollands recently just broke his own rule but for a good reason – to diversify away from the very concentrated S&P 500.

This is becoming a concern for many investors because of the dominance of the Magnificent Seven companies, which now make up almost 40% of the US market. Passive investors are particularly exposed to the risk, said Hollands.

“Probably we are in a bubble, but it could be one that runs on for some time. All bubbles eventually burst and usually in a pretty ugly way. A lot of people can be very exposed to it, because so many are investing passively,” he said.

To those investors who are heavily exposed to US equities and big tech, as a lot have become by stealth, the Bestinvest managing director suggested taking a step back and diversifying across asset classes and markets.

“If you’re worried about the artificial-intelligence bubble bursting at some point, it’s a big call to sell all of it, so just take some of the risk off the table.”

There are two main ways to do that – either passively or by using actively managed funds that have more of a value bias, he continued.

Investing in an S&P 500 index fund has been a great thing thus far, but the number one thing worried investors should do today is to make sure they haven’t got three-quarters of their portfolio in US equities.

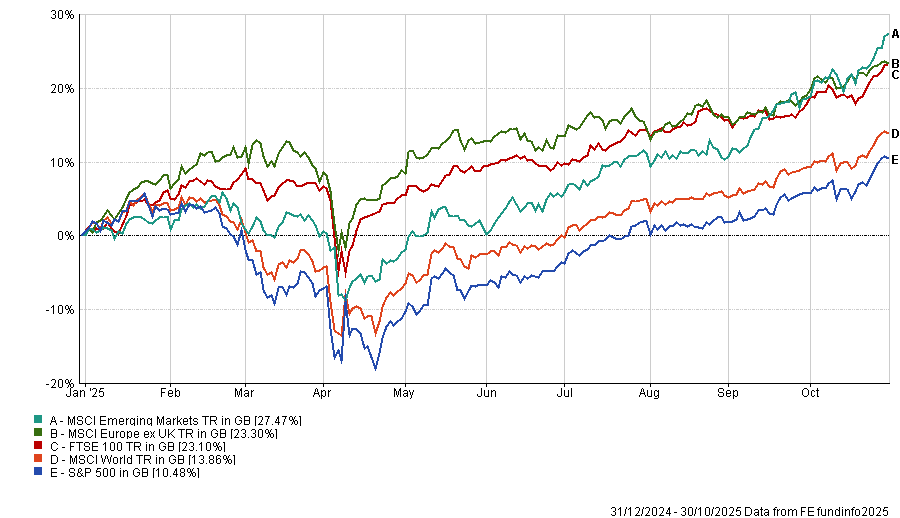

“There’s other stuff out there, and as this year has proven, the other stuff’s doing pretty well,” Hollands said.

Performance of indices over 1yr

Source: FE Analytics

“Personally what I did is I switched half of my S&P 500 passive exposure into an equally-weighted version. By splitting my allocation in half, I broke my 20-funds rule. But that’s ok because it’s not a magic number. It’s just good to set yourself any number as a discipline.”