With government debt levels surging and long-term interest rates of the rise, investors are facing a markedly different yield environment than in recent years, prompting them to reassess where value and resilience can be found.

Trustnet asked fund pickers to select funds they believe are well-positioned to benefit from this shift – from short-duration bond funds and high-yield credit to equity portfolios with strong pricing power.

One possible outcome of rising debt levels is that governments may seek to inflate their way of out of the problem.

According to Darius McDermott, managing director at FundCalibre, such an environment suits short-duration inflation-linked bonds.

“These can be an effective hedge against rising rates and the erosion of real returns,” he said, pointing to Artemis Short Duration Strategic Bond and TwentyFour Dynamic Bond.

He said they are both “nimble, flexible and able to adjust duration and credit exposure as conditions evolve”.

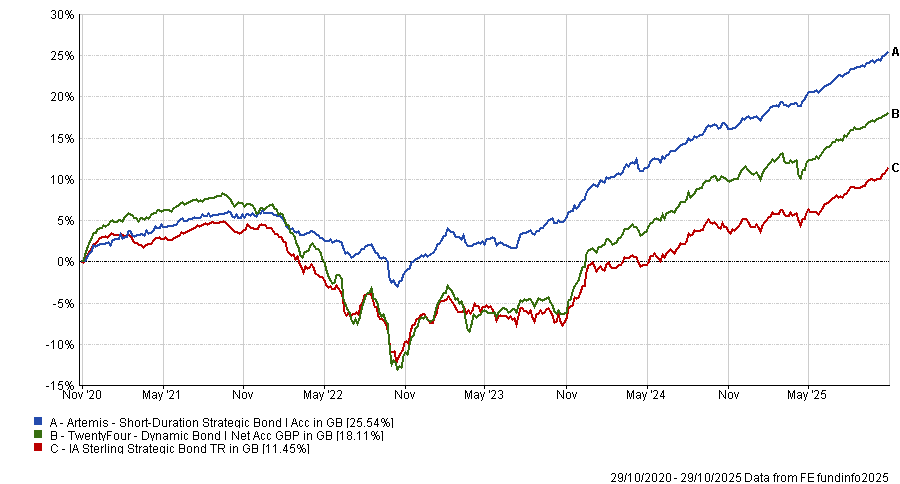

Both funds have an FE fundinfo Crown rating of five out of five. However, the £636.3m Artemis fund has outperformed the £1.7bn TwentyFour fund over five years, gaining 25.5% versus 18.2%.

Performance of the funds vs sector over 5yrs

Source: FE Analytics

James Carthew, head of investment company research at QuotedData, selected the £330.3m investment trust CQS New City High Yield, which invests in high-yielding fixed-interest securities.

“By focusing on high yield issues, where credit spreads can have more of an impact on returns than shifts in the risk-free rate, and by keeping the duration relatively tight at about three years currently, the manager was able to navigate the post-Covid environment of rising interest rates successfully,” he said.

The trust has a strong long-term track record, with a five-year annualised net asset value (NAV) return of 10.4%. It has traded at a premium to NAV almost since launch – the premium currently sits at 6.6%.

“The portfolio is very differentiated from peers, with a bias to relatively small issues which tend to attract a yield premium, and in securities that the manager feels are undervalued,” Carthew said. “The approach means that good credit is vital to the trust’s success.”

Dividends to shareholders have also been “climbing steadily”, increasing each year for the past 18 years to today’s 9%. “The trust has a revenue reserve to cushion the impact of any short-term revenue shortfall,” Carthew added.

He also noted a bias to sterling issuers in the portfolio, which reduces the effect of adverse foreign exchange movements.

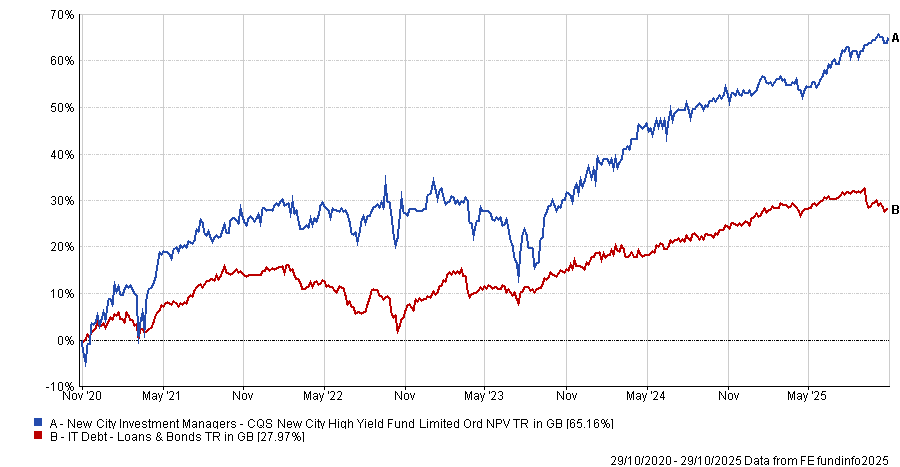

Although the trust languished in the fourth quartile for total returns in its sector over three years, it was in the first quartile over one, five and 10 years – gaining 104.7% over the decade.

Performance of the trust vs sector over 5yrs

Source: FE Analytics

Meanwhile, Tom Bigley, fund analyst at interactive investor, selected the Man Income fund.

“Rising long-term interest rates suggest markets expect inflation to remain above the Bank of England’s 2% target, or that investors are demanding greater compensation for inflation and fiscal risk,” he said.

As such, funds in the IA UK Equity Income sector, including Man Income, offer potential for both income and capital growth above the rate of inflation, Bigley suggested.

The £2.2bn strategy is managed by FE fundinfo Alpha Manager Henry Dixon and co-manager Jack Barrat and seeks superior capital returns to the FTSE All-Share alongside a higher yield – currently just above 5% versus around 3.3% for the benchmark.

“This generous yield may help cushion returns if elevated bond yields continue to pressure equity valuations, offering investors an appealing income premium is a higher-rate environment,” Bigley said.

The management team looks for cash-generative companies trading below estimated asset values, companies whose valuation under-represents profit streams relative to their cost of capital and companies with net cash balances and strong cash flows.

Top holdings include British multinational pharmaceutical and biotechnology company GSK and mining major Rio Tinto.

“The valuation-conscious approach is expected to perform well in an environment more favourable to value stocks and in a rising bond yield environment, given its discipline on the cost of capital and balance sheet strength,” said Bigley.

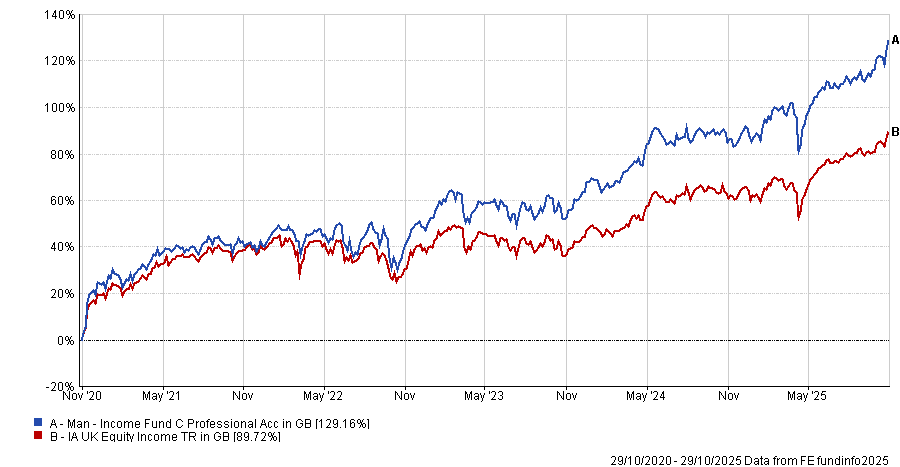

The fund has an FE fundinfo Crown Rating of five and has delivered top quartile returns for its sector over three, five and 10 years.

Performance of the fund vs sector over 5yrs

Source: FE Analytics

Finally, Paul Angell, head of investment research at AJ Bell, picked Aegon High Yield Bond.

“High yield bonds are typically shorter maturity than their investment grade counterparts, resulting in high yield funds being less sensitive to yield curve moves (duration) and quickly repricing to capture any rising yields available in the market,” he said.

The managers of the £1.3bn fund – Thomas Hanson and Mark Benbow – are index agnostic in the management of the strategy, “believing passively investing in a high yield index is nonsensical given indices are weighted to the most indebted businesses”, Angell explained.

As such, Aegon’s global team of credit analysts help to generate the individual bond ideas that populate the portfolio, which is also managed from a top-down perspective.

“The co-managers have successfully navigated the Covid pandemic and rising interest rates, delivering outperformance of the market in both up and down markets, as well as top quartile returns within the peer group,” Angell said.

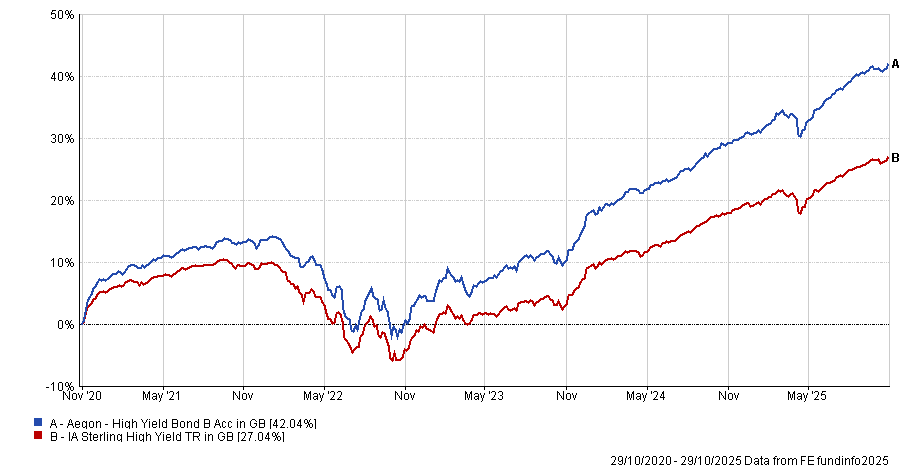

Indeed, the fund has logged top-quartile returns over one, three, five and 10 years, gaining 70.8% over the decade versus the sector average of 53.6%.

Performance of the fund vs sector over 5yrs

Source: FE Analytics