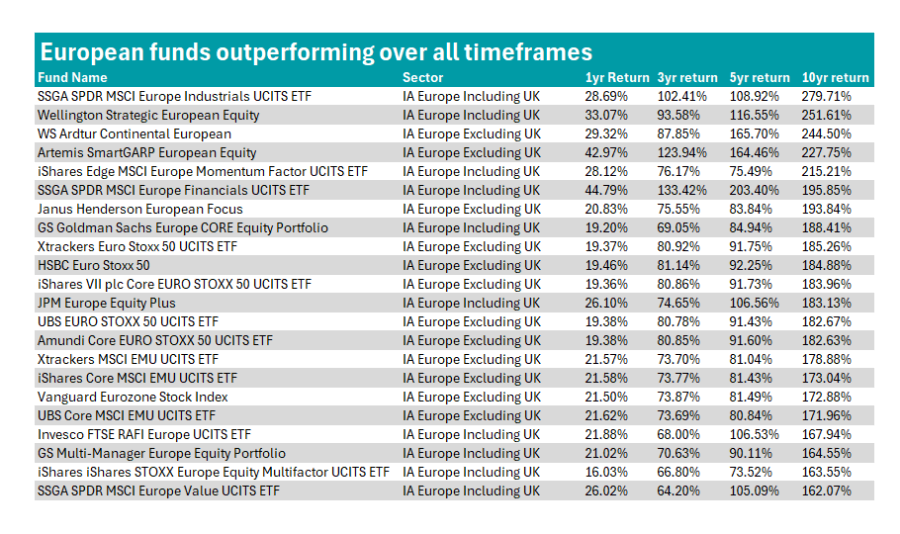

Europe often has a reputation as a region for active stock pickers, but the funds that have performed best in the region over standard timeframes have been mostly passive funds, according to Trustnet research.

Indeed, 22 funds across the IA Europe ex UK and IA UK Europe including UK sectors have delivered top returns over the past one, three, five and 10 years, with 15 of them being trackers or exchange-traded funds (ETFs).

Source: FE Analytics. Data accurate to end of September. Chart is sorted by 10-year performance.

For Ben Yearsley, director at Fairview Investing, this is not entirely surprising.

“The thing people forget is that passives have an inherent advantage; they don’t have to worry about being overweight a stock.” Under the European UCITS regulations, active funds cannot hold 10% of their assets in any single company.

Passive funds do not have this limit, meaning that they can allocate more to outperforming stocks even if they become much bigger positions. For example, ASML currently represents 8% of the Euro Stoxx 50, an allocation many active managers might be uncomfortable with.

This is one reason why funds that track an index such as the Euro Stoxx or MSCI EMU have performed very well over the long term, Yearsley explained. Additionally, this year’s best-performing parts of the European market “tend to be unloved by active managers”.

A big example of this is industrial stocks, which have been “largely ignored by fund managers” due to being considered “relatively dull”.

However, these stocks have been one of the region’s “few bright spots” with passives tracking industries such as the SSGA SPDR MSCI Europe Industrials UCITS ETF surging 279% over the past 10 years, the best total return in the IA Europe including UK sector.

Yearsley added that the popularity of sustainability mandates in 2020 and 2021 means active managers have discounted defence stocks in the industrials space, which has caused them to lag when these names started surging due to geopolitical tensions.

European financial stocks have been in a similar situation because “most managers haven’t liked them in years”.

However, they’ve been “phenomenal performers”, Yearsley noted, with the MSCI Europe/Banks index up 357.9% over the past half a decade, beating the S&P 500. As such, passive funds such as the SSGA SPDR MSCI Europe Financials UCITS ETF have delivered top-quartile returns over all standard time frames.

“I think this performance caught a lot of managers by surprise,” and so they were underexposed when the rally began, according to Yearsley.

However, while passives dominate the list of funds, some active funds also had their place.

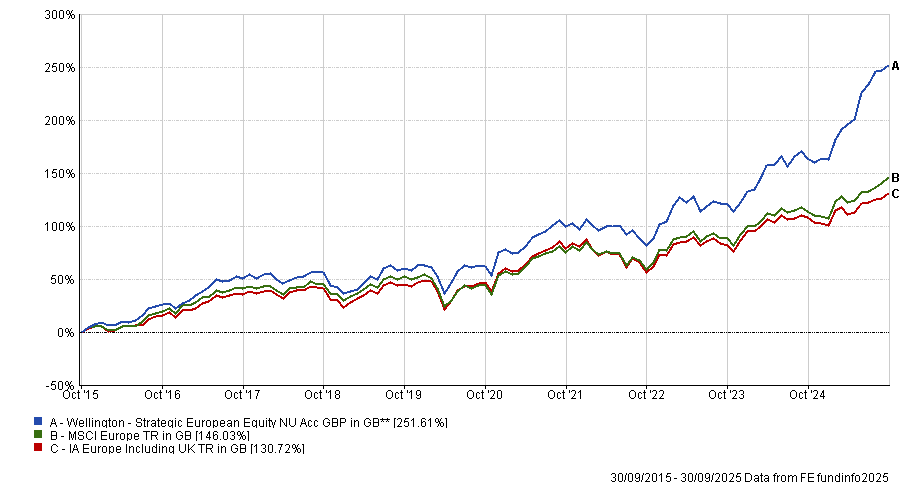

For example, the Wellington Strategic European Equity fund has ranked in the top-quartile of the IA Europe including UK sector over the past one, three, five and 10 years.

Performance of fund vs sector and benchmark over past 10yrs

Source: FE Analytics. Data accurate to end of September

The strategy is a high-conviction fund targeting companies that can grow earnings and cash flow far faster than the market average.

FE fundinfo Alpha Manager Dirk Enderlein makes full use of his ability to invest in the UK, with stocks such as British American Tobacco and Unilever featured alongside European names such as Rheinmetall in the top 10 allocations.

The fund is currently soft-closed to new investors.

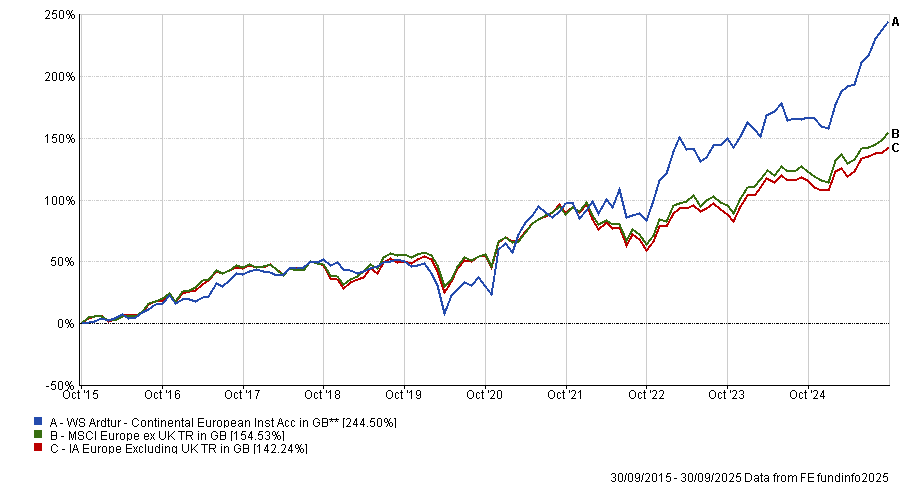

Another outperforming active fund option is the WS Ardtur Continental European fund.

Performance of fund vs sector and benchmark over past 10yrs

Source: FE Analytics. Data accurate to end of September

Run by Oliver Kelton, the manager focuses on a concentrated selection of mid and small-cap names, with just 27 holdings. In total, the top 10 allocations represent 55% of the total assets.

However, investors should note that Kelton has only led the portfolio since 2023 and so is not entirely responsible for the strong long-term returns.

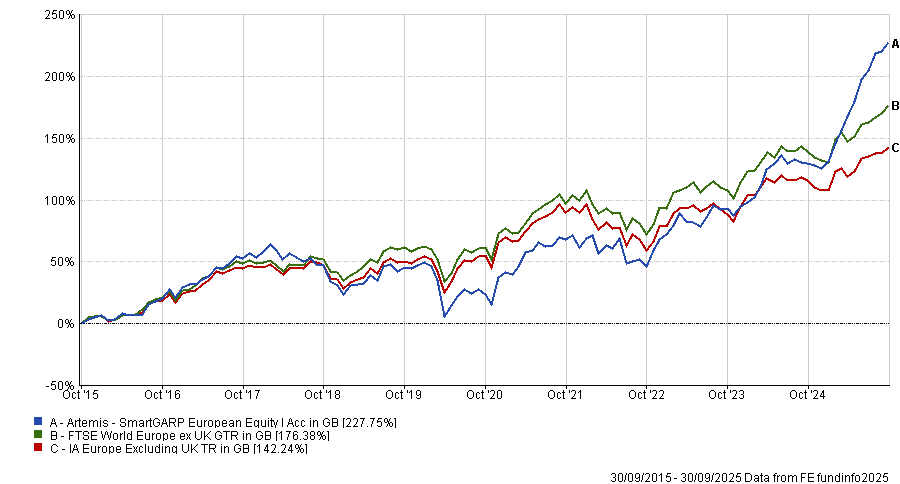

The Artemis SmartGARP European Equity fund also appeared on the list, ranking within the top 5 funds in the IA Europe ex UK sector over all standard timeframes.

Performance of fund vs sector and benchmark over past 10yrs

Source: FE Analytics. Data accurate to end of September

The SmartGARP process screens for companies that are growing faster than the market but trading on lower valuations, while also benefiting from helpful economic trends.

The strategy is well-regarded by the team at Rayner Spencer Mills Research (RSMR), who highlighted the “clearly defined and rigorous process”.

Analysts also praised manager Philip Wolstencroft for his adaptability and choice to emphasise more reliable growth measures after the fund experienced some underperformance.

“These changes demonstrate pragmatism on the managers’ part and are an enhancement to a strategy with a proven ability to perform,” the analysts concluded.

Other top quartile active European funds are the Janus Henderson European Focus fund, the Goldman Sachs Europe Core Equity Portfolio and the GS Multi-Manager Europe Equity portfolio.