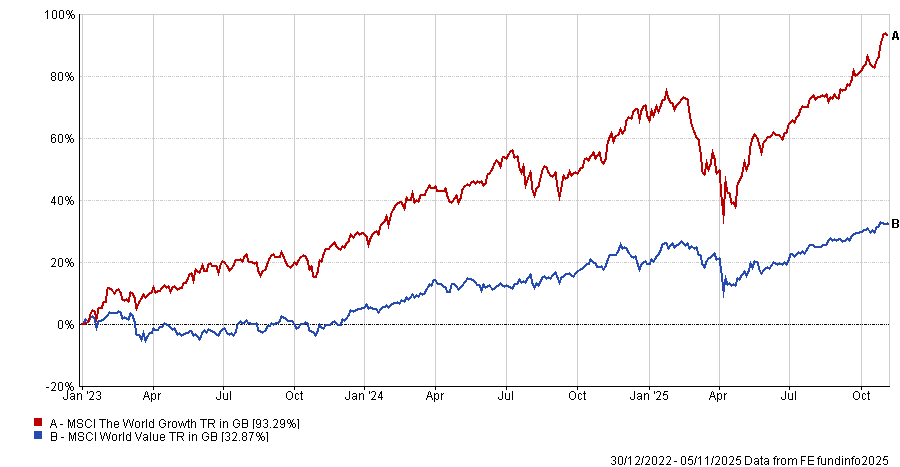

Value investing has been in the doldrums for the past three years. Don’t believe me? Just take a look at the chart below.

Since the start of 2023, the MSCI World Growth index has trounced its value counterpart, up 93.3%, almost triple the return of its sister index.

FE Analytics data goes back to 1999. Since then, the value index has beaten growth in 10 calendar years, while growth has won out 16 times.

The early 2000s were a high point, with investors nervous to reinvest in technology following the dot-com bubble. However, after 2007, this style of investing has only been in favour four times, two of which came in 2021 and 2022.

Post the pandemic, unloved stocks such as oil and miners recovered as the economy began to get back to normal, while higher interest rates boosted the returns of banks. Admittedly, this is a simplistic generalisation, as there were many other factors.

The other two periods where value outperformed growth were in 2008 (the global financial crisis) and the energy crisis/Brexit referendum in 2016.

All this shows that value investing comes into its own when markets are struggling. Otherwise, growth is the place to invest.

At present, the main reason to be bearish is valuations and there is a real debate over whether we are on the cusp of an artificial intelligence (AI) bubble or not.

As Gary Jackson wrote this week, Michael Burry, who is known for predicting the 2008 US housing market crash, has bet against the AI stocks that have inflated the market in the past few years.

His hedge fund Scion Asset Management has put options against 1 million Nvidia shares and 5 million Palantir shares worth $187m and $912m respectively.

Few argue that we are in a bubble. While AI technology is undoubtedly revolutionary, valuations are high and there are real reasons for investors to be concerned.

Performance of indices since the start of 2023

Source: FE Analytics

Geopolitical tensions, circular vendor financing (companies providing or promising cash to each other for future projects that may never be fulfilled) and the vast energy supply needed to power the technology are all real concerns for the longevity of the current bull market.

But fewer still are willing to actively bet against it. Even Burry’s put options, for example, are viewed as a hedge to the firm’s market positions, rather than an outright bet that the market will go to hell in a handbasket.

Others in Jackson’s article were even more effusive, stating that investors should expect the AI boom to continue from here for some time, even though at some point they accepted there could be a crash.

Based on the data, fans of value funds (and indeed the managers of such portfolios) will be hoping that the bubble does not have long left to inflate. After all, recent history shows that this is the only time value strategies win.

Of course, there are always strategies that can do well even with their style out of favour, as Peter Toogood, co-managing director of investments at Fund Research Centre, pointed out this week.

But not all of us are expert fund pickers.

So for those of us unsure of what comes next (and with no insight on which funds can buck the trend), the best bet is to have a bit of both.

Timing the market is rarely a good idea, but right now it would appear a growth bias is the logical choice, given few are outrightly bearish on markets.

However, investors should have some value strategies in their portfolio just in case and be prepared to pivot quickly by selling down growth assets in favour of value at the first signs of trouble. If in doubt, it’s usually better to move early than late.