Investors have been worrying about the increasing concentration in equity markets but might have underestimated the same phenomenon in fixed income.

The US market makes up about 60%-70% of global investment grade and global high yield bonds, but investors aren’t being paid enough to take such risk, according to Matthew Rees, FE fundinfo Alpha Manager of the L&G Strategic Bond fund.

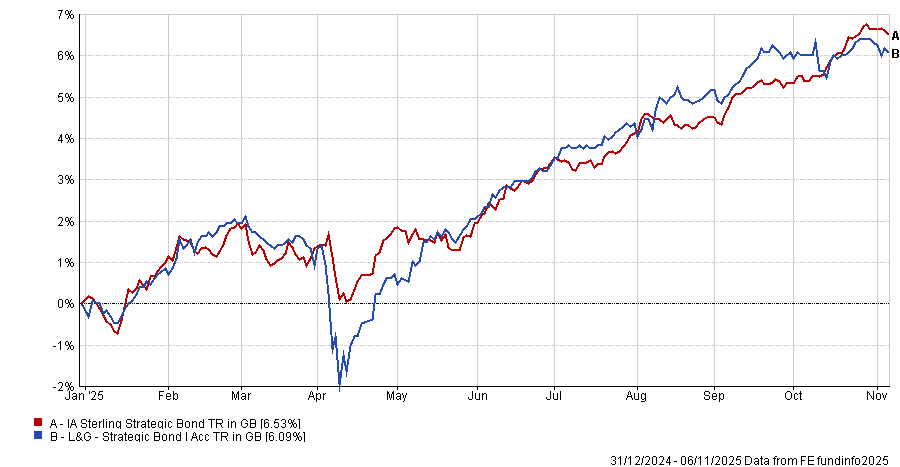

The strategy holds a maximum FE fundinfo five-Crown Rating of five and made a top-quartile return against its IA Sterling Strategic Bond peers over the past three and five years, while remaining in the second quartile for performance over a decade. Relative performance has also been positive over the year to date, as the chart below shows.

Performance of fund against index and sector over 1yr

Source: FE Analytics

Below, the manager discusses why he cut his US and UK exposure, why it’s important to be unconstrained and recalls “a proper stinker” moment in his career.

What’s the philosophy behind the fund?

We believe in very strong diversification and being active in duration management.

We diversify by asset class, country and borrower – fixed income can be a depressing asset class, where you hopefully get a coupon but if you get it wrong, you lose everything. Diversification by borrower ensures that when you make mistakes, it's not too painful.

We're also unique in how we think about duration, which we use as a hedge against our credit book. Long-term returns from duration are not great and incredibly volatile – using duration as a hedge is much better. We are actively contrarian with many of our active duration trades when we see consensus going too far one way.

How do you implement the philosophy?

We have a team of quants who help us create a strategic asset allocation framework over time. When you're running an unconstrained fund and you can do almost anything, a quant-driven process stops you from falling in love with an asset class or being influenced by the person who's shouting loudest or most influential in the room.

Then we tactically move across those asset classes when we think it's right, but within that framework of our strategic allocation.

What have your most recent, largest trades been?

We reduced risk mid-year by raising our cash buffer and adding some CDS [credit default swap] hedges, as spreads weren’t paying for the risk despite confidence in [US President Donald] Trump’s TACO trade and the US economy.

Our cash position rose by about 2-3 percentage points to between 5% and 10%, which we maintain today given tight spreads and more frequent volatile periods, which show greater market sensitivity to macro and valuation extremes.

The biggest change this year came after Liberation Day, when we reduced our portfolio risk in our higher-beta areas by about 6% to 7% because the tail risk of what Trump had put into the economy was quite big.

What changes have you made on a regional basis?

The US market makes up about 60%-70% of global investment grade and global high yield. When we look at where US spreads are, and with the economic uncertainty that still exists, we don’t think you’re really being paid for that much risk.

Our US exposure is quite low, about 15% of the fund, compared to 60–70% for a benchmarked investor. This is why it’s such an important moment for investors to be thinking about flexibility and to be unconstrained.

We’ve also reduced our UK exposure by about 6–7% over the past four to six weeks, to around the same level as the US, as we took profits on some strong investments in UK water and UK banks. With the uncertainty around the Budget event and its potential impact on UK assets, we felt that higher concentration in the UK was too much.

What was the best-performing position this year?

The best performing has been in bank capital, specifically Close Brothers. We owned the subordinated debt security, its AT1, which is a very high coupon deal. Our analyst did great work back when the car finance issue blew up, looking at how much trouble it could be in and whether it might go bust. We didn’t think it would, so we bought that early and in enough size. The AT1 we bought returned about 31% over the past 12 months, which, for fixed income, is a large return. We had a decent position in it, about 1%, so we made around 3% total return at the fund level.

And the worst?

Our worst performer has been a more recent one. Thankfully, we haven’t had any proper stinkers over the past 12 months, but we bought into Mobico, the National Express operator, when it was starting to get into some trouble. The bonds have since been punished a bit more, going down about 16% total return since we bought them. We only had a 0.2–0.3% position, so at the portfolio level it hasn’t had a massive impact. We’ve probably lost about 30 to 40 basis points on that position.

We’ve held on to it. It’s rallied quite well in the past three or four weeks. Our analyst doesn’t think the company is going bust or anything horrible like that, and it’s started to sign a few new contracts, including one in Saudi Arabia, which shows it’s operating as a normal business, which to us is really important.

What do you remember in your career for being “a proper stinker”?

A lot of people ask whether the gilt crisis was as bad as the financial crisis. I was in a hedge fund during the financial crisis – the gilt crisis for me was a walk in the park. Earlier in my career, during the financial crisis, we had two times leverage, which really showed me the perils of leverage.

At L&G, Credit Suisse AT1 was difficult. We had some exposure to that and, unfortunately, we made the wrong call. We didn’t think it would go bust, and we definitely didn’t think the Swiss government would do what it did. Over the past seven years that’s probably been the most interesting period.

My key philosophy has always been to learn from your mistakes. If you’re going into something risky – and we have to go into things that are risky – make sure your position sizes are small enough to cope with it. Luckily, with Credit Suisse, we still had great performance in 2022. It’s all about making sure your position sizes are right.

What areas are risky right now?

Long-duration US investment grade is a concern. Spreads have been as tight as they were back in 1997, which is basically when I started in fixed-income markets.

There’s a lot of supply coming from the capex wave driven by the hyperscalers in the US. We saw a big Meta deal [last week], and Oracle has also issued a lot over the past month or so. Some of that will definitely come at the long end. Overall, we don’t like US long-duration investment grade; I think it’s quite a dangerous area, so we’re very selective in what we do.

What do you do outside of fund management?

I play a lot of hockey. I used to coach it, which I absolutely loved, but gave that up three years ago. I'm old now but I still run around the hockey pitch, although not very fast. I've got three dogs, so I do lots of walking in the hills with them and my wife.